The client is a leading ratings analysts institution.

Challenge

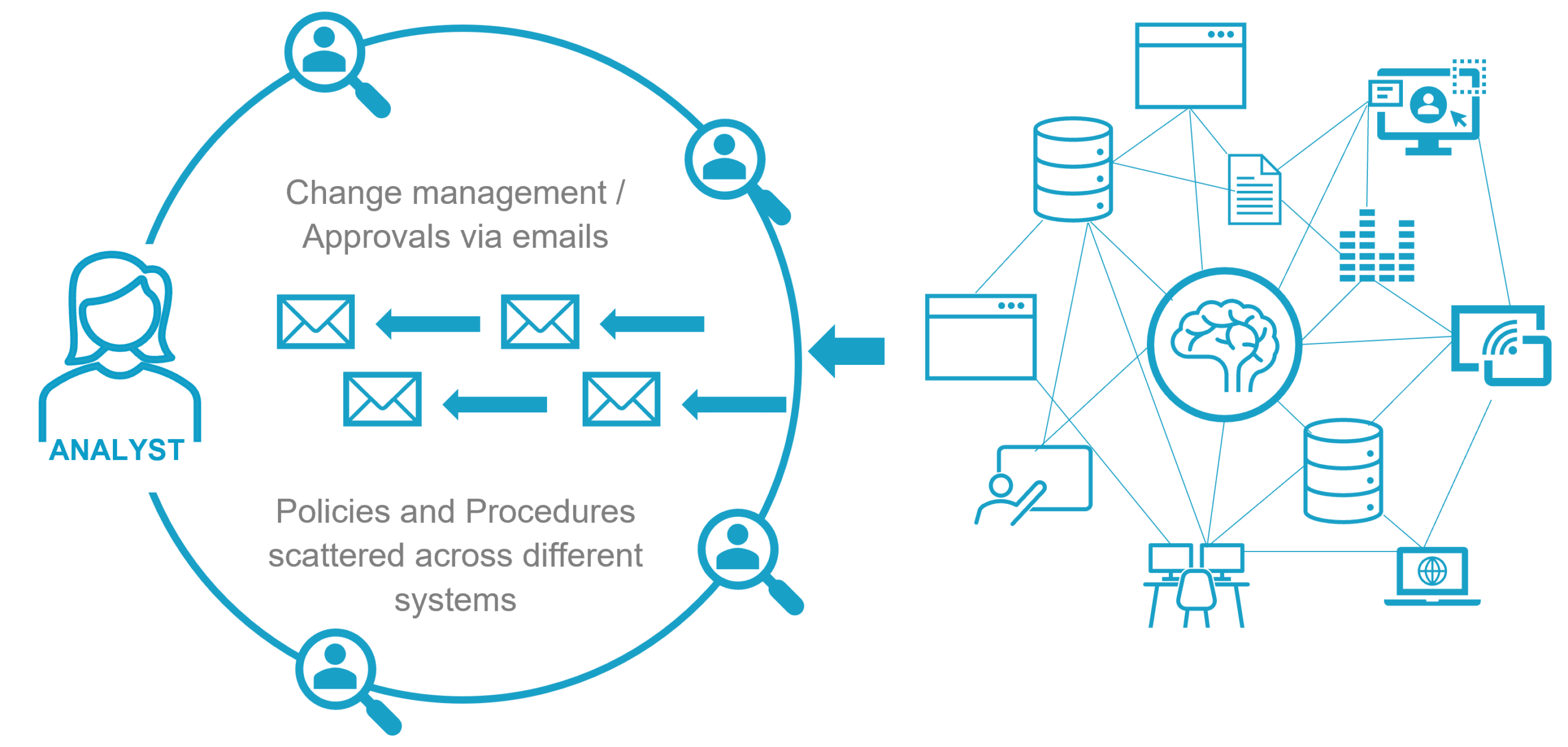

Balancing the responsibilities of a Ratings Analyst while complying with ever-changing compliance rules, company policies, procedures, best practices, and other unwritten protocols, can be a daunting and time-consuming process.

The client’s analysts struggled with a complex compliance process that included thousands of protocols across multiple systems. An analyst’s day-to-day job required the recall of too much information that was possible to retain. Analysts needed to rely on recall of earlier training, and find updates on that information, documentation for applications was very unstructured with heavy images embedded and did not have a direct Q&A format.

Complex Compliance Process with Multiple Systems to Access

This resulted in 20-30% of unproductive time for the analysts in the firm, who represented the majority of revenue-generating employees.

Solution

Orion helped the client develop a business case to demonstrate the capability of intelligent automation (AI/ML) platform to address this challenge.

“The Orion chatbot Proof of Concept was the most seamless and rapid experience of any software that I’ve [worked with]. No technology resources were required, and we gained a transparent view of all functions, along with demos, trainings, and detailed answers to our questions. I feel confident that I have all the information required for the business to make decisions.” – SVP, Research Operations, Top Ratings Analysts Firm

On completion of the successful pilot of this business case and after achieving the desired ROI, Orion partnered with Rezolve.ai to build a next-generation conversational AI chatbot using AI/ML technology. The objective was to assist analyst users to access relevant information of applications quickly and accurately and streamline the process throughout their workflow. The solution included an FAQ Chatbot for several of the client’s applications to assist their analysts in their day-to-day work.

See the video below on how the solution was implemented.

Impact

It is estimated that our client saved 30% of their analysts’ work day with the reduction in the need for searching content across various applications. It also resulted in better compliance with policies and procedures.